Are Service Contracts Taxable In Georgia . many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. are services subject to sales tax in georgia? unlike sales of tangible personal property, which are generally presumed taxable, sales of services are not subject to the tax. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. The state of georgia does not usually collect sales tax from the vast majority of. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. While georgia's sales tax generally applies to most transactions, certain items have special. are services subject to sales tax?

from eforms.com

for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. are services subject to sales tax in georgia? are services subject to sales tax? in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. The state of georgia does not usually collect sales tax from the vast majority of. While georgia's sales tax generally applies to most transactions, certain items have special. unlike sales of tangible personal property, which are generally presumed taxable, sales of services are not subject to the tax. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing.

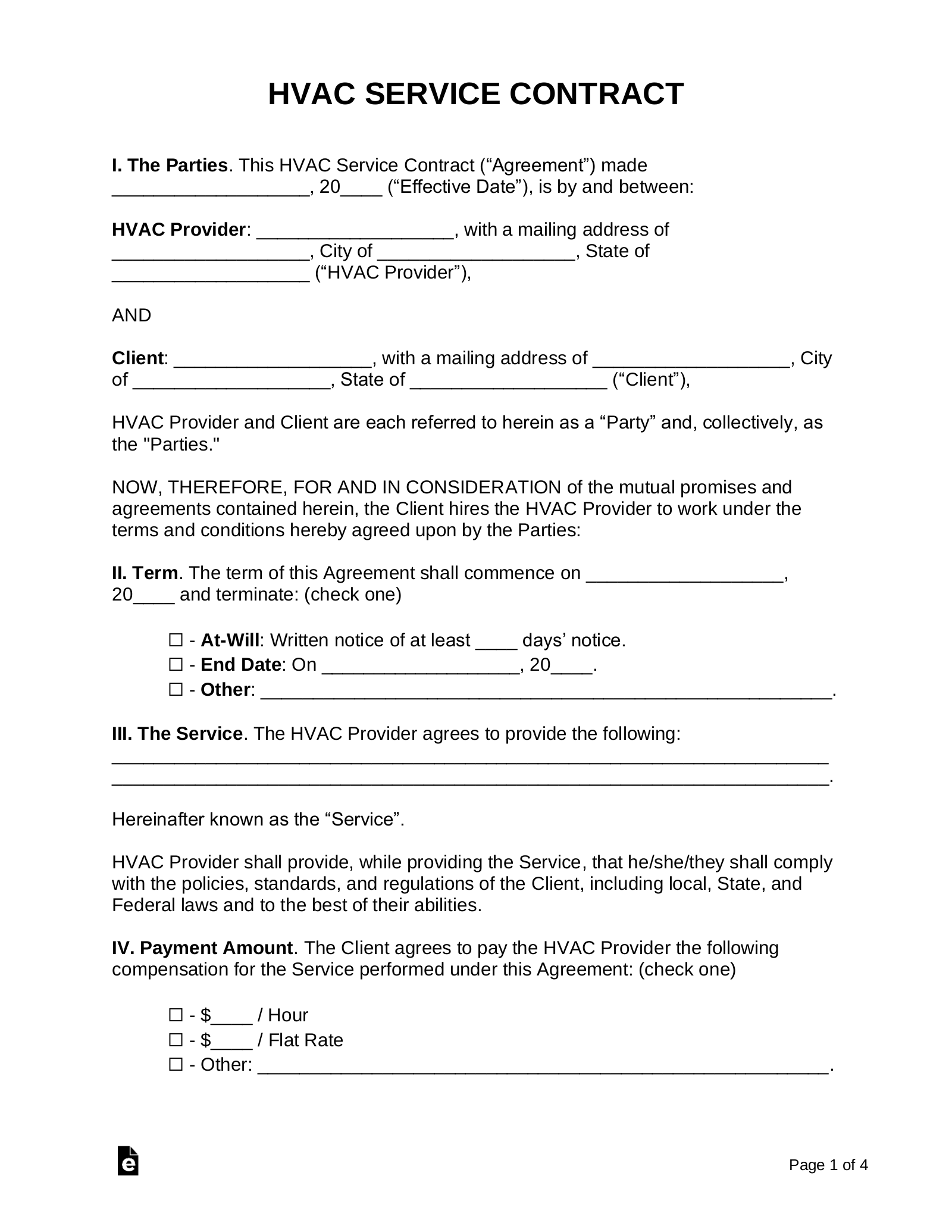

Free HVAC Service Contract Template PDF Word eForms

Are Service Contracts Taxable In Georgia unlike sales of tangible personal property, which are generally presumed taxable, sales of services are not subject to the tax. are services subject to sales tax? unlike sales of tangible personal property, which are generally presumed taxable, sales of services are not subject to the tax. The state of georgia does not usually collect sales tax from the vast majority of. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. are services subject to sales tax in georgia? While georgia's sales tax generally applies to most transactions, certain items have special. many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a.

From govspend.com

The 411 on Government Contracts GovSpend Are Service Contracts Taxable In Georgia for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. While georgia's sales tax generally applies to most transactions, certain items have special. The state of georgia does not usually collect sales tax from the vast majority of. are services subject to sales tax? unlike. Are Service Contracts Taxable In Georgia.

From www.dexform.com

SERVICE CONTRACT Sample in Word and Pdf formats Are Service Contracts Taxable In Georgia in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. unlike sales. Are Service Contracts Taxable In Georgia.

From employmentcontracts.com

Independent Contractor Agreement PDF Word Are Service Contracts Taxable In Georgia unlike sales of tangible personal property, which are generally presumed taxable, sales of services are not subject to the tax. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. The state of georgia does not usually collect sales tax from the vast majority of. While georgia's sales tax generally. Are Service Contracts Taxable In Georgia.

From animalia-life.club

Service Delivery Agreement Template Are Service Contracts Taxable In Georgia in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. The state of georgia does not usually collect sales tax from the vast majority of. many companies assume. Are Service Contracts Taxable In Georgia.

From www.megadox.com

Caregiver Service Agreement Legal Forms and Business Templates Are Service Contracts Taxable In Georgia many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. are services subject to sales tax in georgia? The state of georgia does not usually collect sales tax from the. Are Service Contracts Taxable In Georgia.

From eforms.com

Free HVAC Service Contract Template PDF Word eForms Are Service Contracts Taxable In Georgia many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. are services subject to sales tax? are services subject to sales tax in georgia? this page describes the taxability. Are Service Contracts Taxable In Georgia.

From www.pandadoc.com

What is a Service Contract, Types and Examples Pandadoc Are Service Contracts Taxable In Georgia are services subject to sales tax in georgia? While georgia's sales tax generally applies to most transactions, certain items have special. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. unlike sales of tangible personal property, which are generally presumed taxable, sales of services are not subject to. Are Service Contracts Taxable In Georgia.

From juro.com

service agreement template free to use Are Service Contracts Taxable In Georgia The state of georgia does not usually collect sales tax from the vast majority of. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. are services subject to sales tax? for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a. Are Service Contracts Taxable In Georgia.

From slideplayer.com

Contract Management. ppt download Are Service Contracts Taxable In Georgia this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. While georgia's sales tax generally applies to most transactions, certain items have special. are services subject to sales tax? are services subject to sales tax in georgia? many companies assume services delivered in conjunction with goods sold (e.g.,. Are Service Contracts Taxable In Georgia.

From www.dexform.com

Example of SERVICE CONTRACT in Word and Pdf formats Are Service Contracts Taxable In Georgia are services subject to sales tax? in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. While georgia's sales tax generally applies to most transactions, certain items have special. for. Are Service Contracts Taxable In Georgia.

From www.rocketlawyer.com

Free Contract for Services Template Rocket Lawyer Are Service Contracts Taxable In Georgia for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. While georgia's sales tax generally applies to most transactions, certain items have special. are services subject to. Are Service Contracts Taxable In Georgia.

From www.dexform.com

Service Contract in Word and Pdf formats Are Service Contracts Taxable In Georgia are services subject to sales tax in georgia? While georgia's sales tax generally applies to most transactions, certain items have special. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. . Are Service Contracts Taxable In Georgia.

From roadsumo.com

What is a Vehicle Service Contract? Your Guide to Understanding Car Are Service Contracts Taxable In Georgia are services subject to sales tax in georgia? for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. unlike sales of tangible personal property, which are generally. Are Service Contracts Taxable In Georgia.

From www.typecalendar.com

Free Printable Residential Service Contract Examples [PDF] Are Service Contracts Taxable In Georgia for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use. Are Service Contracts Taxable In Georgia.

From slideplayer.com

Making Funding Work For You ppt download Are Service Contracts Taxable In Georgia many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. The state of georgia does not usually collect sales tax from the vast majority of. While georgia's sales tax generally applies. Are Service Contracts Taxable In Georgia.

From especiales.europasur.es

Writing service contract agreement; Writing service agreement contracts Are Service Contracts Taxable In Georgia in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. While georgia's sales tax generally applies to most transactions, certain items have special. for example, a medical service provider purchases oxygen from a seller and then sells the oxygen to a patient pursuant to a. many companies assume services delivered. Are Service Contracts Taxable In Georgia.

From www.typecalendar.com

Free Printable Lawn Care Contract Templates [Proposal] Agreement Are Service Contracts Taxable In Georgia The state of georgia does not usually collect sales tax from the vast majority of. are services subject to sales tax in georgia? many companies assume services delivered in conjunction with goods sold (e.g., swimming pool and pool cleaning, computers and maintenance,. While georgia's sales tax generally applies to most transactions, certain items have special. this page. Are Service Contracts Taxable In Georgia.

From www.typecalendar.com

Free Printable Residential Service Contract Examples [PDF] Are Service Contracts Taxable In Georgia this page describes the taxability of optional maintenance contracts in georgia, including parts purchased for use in performing. The state of georgia does not usually collect sales tax from the vast majority of. are services subject to sales tax in georgia? are services subject to sales tax? for example, a medical service provider purchases oxygen from. Are Service Contracts Taxable In Georgia.